Healthcare Facts and Fiction: What the General Public Needs to Understand About Healthcare in America

Understanding healthcare delivery, pricing, payment, and business is a complex animal for dissection. As such, we will initially approach healthcare in a general fashion before deeply dissecting this topic in serial fashion. Today is the first in the series.

Part One: Why Amazon, Berkshire Hathaway, and JP Morgan Recently Announced Their Healthcare Experiment.

THE ISSUE

Last week the big reveal from Amazon, Berkshire Hathaway and JP Morgan Chase was announced with maximal fanfare that burned bright in the news cycle for an entire day. This business triumvirate announced their joining forces to create a healthcare company specifically aimed at reducing their respective domestic employee health costs. Currently, these three companies employ greater than 500,000 people in the US and over one million persons globally. With Amazon and Jeff Bezos's reputation for destroying brick and mortar stores, Warren Buffett's inside the beltway access to government and shrewd business moves and Jamie Dimon's financial behemoth stalking Wall Street, one would think great things to come. Outside of the healthcare sector investors sold off a bit on this news. The rest of us shrugged a collective "whatever". We've seen this play before. The powerful, entrenched characters running healthcare have persevered, even more powerful since the ACA passed. Those characters in order of power remain insurance, pharmaceutical, and medical device companies.

WHO ARE BEZOS, BUFFETT AND DIMON?

"Why these three individuals at this time?" is the seminal question. We know our labyrinthine healthcare is expensive, stuffed with middle men, compliance costs, licensing issues, insurances, and gross overhead expenses few other businesses endure. Starting with billionaire Jeff Bezos, known as a serious type A personality, retail industry disrupter, and sometimes a vulgar expletive, particularly when he uses the Washington Post as his propaganda mouthpiece or buys Whole Foods and turns it on its head. Yet Bezos is a master of streamlining supply chains, squeezing efficiencies, and reducing overhead by integrating technology and logistics. Oh, and he has been quietly investigating the pharmacy distribution business in several states over the past years making some pharmacy benefit managers (PBMs) a bit nervous.

Octagenarian Warren Buffett brings his "grandfather knows best" swagger with sayings like, "The ballooning costs of healthcare act as a hungry tapeworm on the American economy." The billionaire has a cult following amongst his shareholders where his annual open stock meeting plays to tens of thousands who make the pilgrimage to his home town Omaha, Nebraska. More importantly, he has the government's ear where he knows intimately how the system works. His father was a Nebraska senator, so he learned which arms to twist and how hard. His contacts run deep in D.C.

Another billionaire, Jamie Dimon, chief executive of the largest U.S. bank, JPMorgan Chase & Company rounds out this audacious trio. He brings financial and business transactional clout as well as central banking experience and connections. He served on the BOD of the Federal Reserve Bank of New York. He rounds out an accomplished trio for this gargantuan task.

WHAT ARE THEY ATTEMPTING?

The three companies are forming a new company, “partnering on ways to address health care." From Jeff Bezos, “Hard as it might be, reducing health care’s burden on the economy while improving outcomes for employees and their families would be worth the effort. Success is going to require talented experts, a beginner’s mind, and a long-term orientation.” Sounds far reaching and altruistic. Perhaps. Reducing overhead is not only a smart business strategy, which Amazon has followed religiously, but a necessary one for growth and continual success.

The smile moment was reading the quote their new company would be “free from profit-making incentives.” From three billionaires this quote seems ingenuous and also unrealistic. Take away the incentive to attain material wealth through hard, smart work and the impetus for success diminishes. We've understood this historically from the original Plymouth Colony embracing a social economic philosophy and nearly perishing to witnessing current day Venezuela. "No profits" begs the question, "How is this system economically sustained?" A question without an answer thus far.

Make no mistake, this new company is about reducing healthcare cost overhead for the respective trio's current business interests. If they can achieve positive results on that scale then look for a national referendum via Amazon, Berkshire, and JPM-Chase utilizing their media power, lobbying networks, political insider relationships, and financial gravitas. Of course they will be integral parts of this system and its profits.

This is a daunting task with great risks. Certainly they will threaten and ultimately alienate certain customers of their respective empires as they gin up their new business entity. Just as certain they risk losing some business and profits while remaining beholden to their stock owners. They are not the first business giants to walk this path. AOL, Microsoft, and Intel with their respective leaders have all ventured into this space only to fail. Success depends on overcoming key hurdles like contracting directly with drug companies and eliminating the PBM or the pharmacy middle man to reduce prices and increase efficiencies.

BARRIERS TO SUCCESS

The keys to success are many. Some are simple, but most are horribly complicated. Numerous details are required for this project and success depends on several key pieces:

1. Insurance companies must be brought under control with concrete reimbursement policies. Far too many horror stories of unreasonably denied claims. This will be difficult as United Healthcare's 2017 revenue, "... exceeded $201 billion increasing more than $16 billion year-over-year. Operating cash flows grew to $13.6 billion..." quoting CEO David Wichmann. (His base salary is $1.1 million with $12.3 million total compensation.) Aetna's 2017 revenue was $60 billion with $1.9 billion earnings. (CEO Mark Bertolini made $41 million in 2016 and may walk from Aetna with $500 million if the CVS merger is realized.)

Take away: health insurance is lucrative with a legislated customer base via ACA.

2. Medical care needs price transparency. Very few people inside healthcare know what procedures and care cost based on varying insurance reimbursements to providers and healthcare systems. It is a convoluted, confusing, and downright diabolical system like health insurance legislated (aided and abetted) by our friends in government.

Take away: Warren Buffett knows insurance as GEICO is wholly owned by him through Berkshire-Hathaway. As stated earlier, Warren knows the DC insider shuffle, so if anyone can develop an insurance product for less he can. He can also garner legislative support through various lobbying groups.

3. Drug costs need to decrease. Americans don't realize they subsidize much of the globes' medicines. Country specific pricing is based on GDP wealth and how well individual countries negotiate prices. Why should Harvoni for Hepatitis C cost $70,000 for a treatment course in the US and $800 in Egypt?Americans are no longer "rich" as the middle class faces extinction through high debt, high taxes and fees, minimal savings (CNBC cites 69% of Americans with less than $1000 and 75% with less than $10,000 savings.) and almost non-existent wage increases (calibrated for inflation) over the past forty years.

Take away: The American consumer is tapped out. Consumer credit card debt is greater than $1,000,000,000,000; student loan debt is greater than $1,300,000,000,000; $8,690,000,000,000 stands in home mortgage debt.

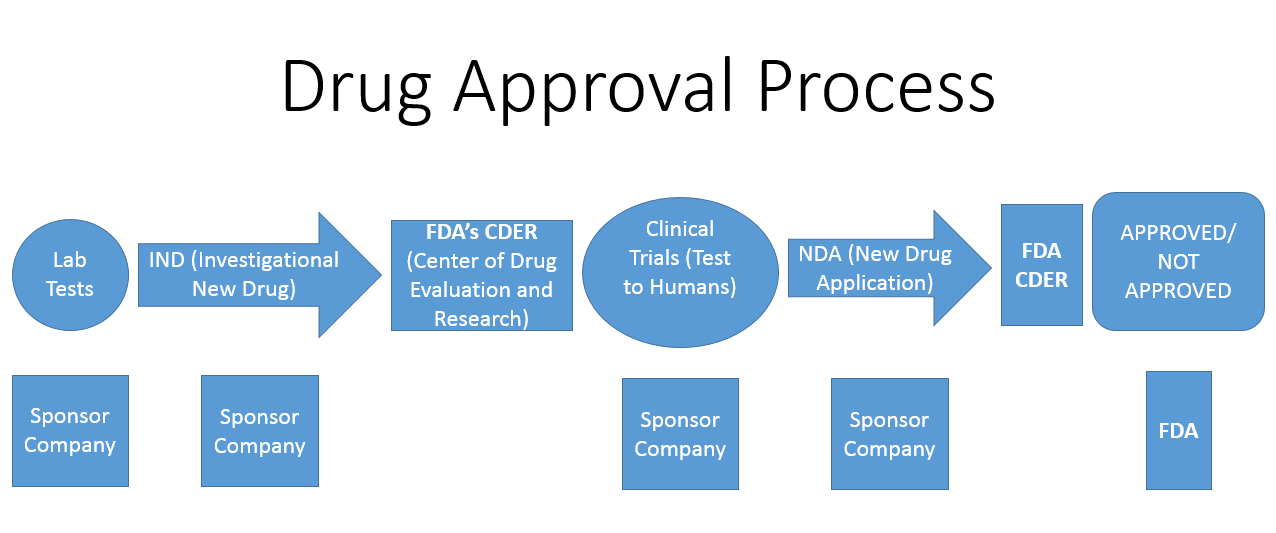

4. Implement immediate FDA reform. Why are pharmaceuticals leading per capita healthcare spending higher? (According to the 2016 Health Care Cost and Utilization Report that examined the per-person health care spending for employer-sponsored insurance members at from Aetna, Humana, Kaiser, and UnitedHealthcare.) One of the major hurdles is a slow, inefficient FDA. Currently it costs a drug company approximately $2,000,000,000 to develop a drug and get it passed by the FDA. Pharmaceutical manufacturers frequently cite the FDA as a significant portion of this price. This situation also exists for medical devices and the FDA.

Take away: It's the government. Get out of the way.

5. Move healthcare transactions and information to blockchain technology to prevent fraud of all sorts and ensure patient medical record privacy free from hacking.

Take away: Blockchain is the answer for clear transactions and patient privacy.

6. Everyone is free to choose, whether too much food or drink, motorcycle riding without a helmet, no seatbelts, drug use, smoking, and other risky behaviors. No problem. Have at it, but no more expecting healthy people subsidizing your bad choices. It's time to truly subsidize healthy choices and well care. Fortunately we are seeing movement in this area.

Take away: Individuals need pay for their own life decisions. Reward good actions versus financially punishing them. The current government debt and pseudo-socialized healthcare system is economically unsustainable.

7. Motivating the individual remains elusive if there is little or no incentive (See number six above). Patient compliance remains a huge factor in sickness and wellness. Think of the diabetic that doesn't watch carb intake, is overweight, doesn't take their meds. Ditto for the patient with heart disease who still smokes, is sedentary, and takes their medication wantonly. Anything given away for free or nearly free loses its value.

Take away: Work at keeping yourself healthy and you will decrease your healthcare costs. It's like turning a light off in a room when not in use to decrease your electric costs.

Next issue we will autopsy pharmaceutical and device costs in our system.

Comments? Email Sid at issueautopsy@blogspot.com