Healthcare Facts and Fiction: What the General Public Needs to Understand About Healthcare in America

Understanding healthcare delivery, pricing, payment and business is a complex dissection. In Part Two of this series we look at drug discovery costs, the FDA and how drugs and medical devices are priced.

Part Two- Drugs and Devices

Who can forget the tale of Martin Shkreli, Turing Pharmaceuticals and Daraprim? Approved by the FDA in 1953, Daraprim was the anti-parasitic drug used to treat malaria, and toxoplasmosis in all patients and more routinely recently for preventing and treating toxoplasmosis in HIV patients. Shkreli's company Turing Pharmaceuticals obtained the rights to the drug in 2015 and existed as the sole supplier of Daraprim. Turing promptly upped the price from $13.50 per pill to $750 per pill and Shkreli became fodder for then presidential candidates and the poster boy for all that is wrong with pharmaceutical prices, healthcare, and unbridled greed.

Ah, drugs. America is awash in drugs. We are the most medicated populace on the planet with almost 50% of adults taking at least one prescription medicine in the past month according to the CDC (1). The Brookings Institute's Hutchins Center (2) reports per capita drug spending at $1112 annually. Pharmaceutical costs continue leading healthcare costs higher to the tune of a 27% spending increase in 2017 (3).

What discovering and developing new drugs and medical devices costs:

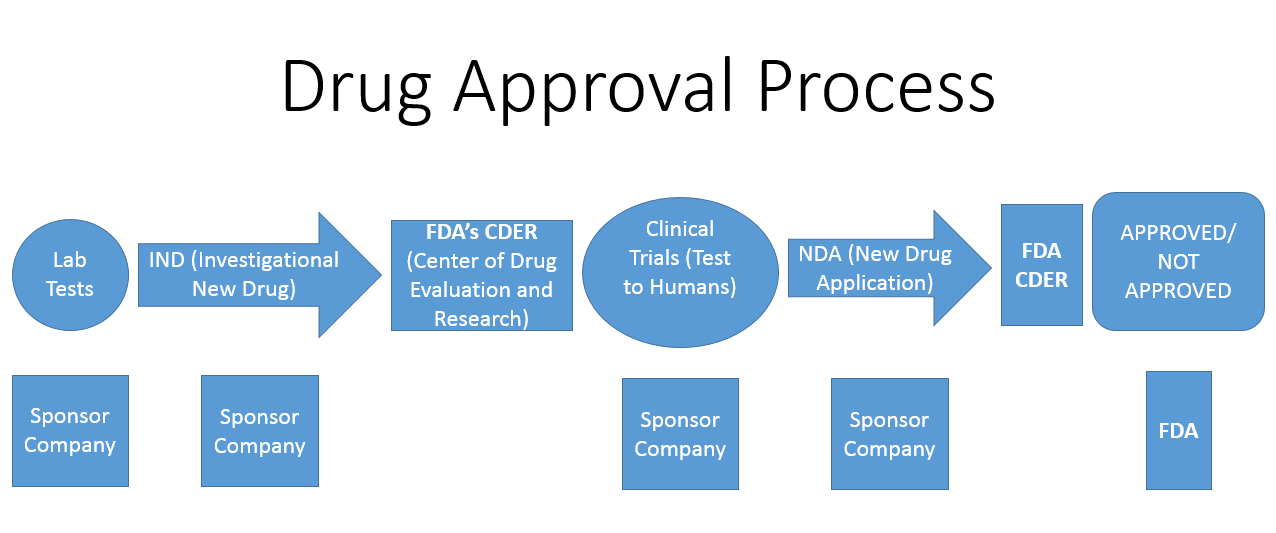

To understand drug costs you need understand the process of drug discovery through FDA approval and marketing. There are five specific steps required to bring any drug to market that spans approximately eight and usually many more years from the first human studies to FDA approval (4):

1. Discovery and Development- A molecule, protein, virus or other biological life form is identified along with its action or potential action in a given disease.

2. Preclinical Research/Phase I- This phase answers the question, "Is the drug safe for humans?"

3. Phase II- Efficacy and safety. Simply, "Does it work and is it safe?"

4. Phase III- Efficacy, safety, and side effects. "What is the best dose for maximizing benefit, minimizing side effects, and what are all the side effects?

5. Post Market Safety Monitoring- monitoring for side effects or therapeutic complications.

The FDA flow chart looks like this:

Keep in mind the entire process is approximately 8 years long in best cases and quite expensive. As in $2.5 billion expensive (5). Certainly this value is variable, but for the most part accurate. Add to that $2,421,495 for the FDA application fee with clinical data and another $304,162 program fee. And that is no guarantee the drug will be approved as approximately only one in ten are granted approval to proceed with sales and marketing. For medical devices the costs are extremely variable and the FDA process is more tortuous, yet much less expensive tolling at less than $1M in fees(6). Regardless, it remains expensive developing and testing a new drug or medical device.

How drugs get from the pharmaceutical company to the patient:

Pharmaceutical companies price their drugs based on many factors including development costs, potential market, competition, and what insurance companies, Medicare and Medicaid will pay. Factoring all variables together helps the drug company arrive at a price known as the list price.

This is the specific point where drug pricing becomes convoluted. The list price is rarely paid. Insurance companies usually contract a pharmacy benefit management company (PBM) like CVS/Caremark or Express Scripts to handle the pharmaceutical portion of their business as do larger businesses and unions. The PBM negotiates the lower drug prices for the insurance company or business under contract. Here's how it works for a month's supply of Drug A:

Drug A's list price is $100

PBM negotiates the price to $60 and then charges the insurer or company $70

The insurance company pays the $60 to the PBM but charges the patient a $10 out of pocket co-pay

The insurance company breaks even (cost neutral), The PBM grosses $10 and the patient pays $10 which doesn't sound too bad for the drug in this example.

PBMs initially entered the medical arena to contract for better drug prices from manufacturers, reduce insurance spending, thus increasing medicine affordability. As drug prices increased new ways evolved to control costs. Most insurers/PBMs set formularies, which are simply a list of drugs they will reimburse. These formulary lists act as expense choke points. Certain rules may apply such as step therapy where a cheaper medicine must be used first and the patient must fail the therapy before a different (more expensive) drug is reimbursed by the insurer. Another cost containment strategy is the tiered formulary structure. In a three tiered reimbursement formulary what this means is Tier 1 is the cheapest for the insurer and patient. Think generics and most older drugs. Tier 2 is reimbursed at a lesser amount by insurance and has a higher co-pay for the patient such as older branded drugs. Tier three are usually newer branded drugs and those not on the insurer's formulary with the patient picking up most or all costs. Another pivotal strategy is prior authorization (PA) where the physician submits for and receives permission from the insurer or PBM to prescribe a drug.

Three main issues with these cost containment strategies exist. First, the physician's clinical decision making is now secondary to whatever the insurance/PBM deems appropriate. Sometimes this is good and keeps the doctors thinking of the least expensive solution. Sometimes it flies in the face of the patient's clinical reality versus what insurance/PBM formulary decision makers want. The second issue is the patient has no say what drugs land on their insurance formulary. Last, but not least, is the responsibility for knowing the formulary structure and obtaining prior authorization (PA) rests on the physician and their ancillary office staff. This costs the patient face time with their doctor and costs the doctor's staff time sending and receiving PAs. A brilliant strategy by insurances/PBMs co-opting medical staff for drug price policing. For the medical community it is another overhead expense and time wasting mandated exercise.

US drug prices vs. the world:

How does the US compare to other countries around the globe? In the first part of this series We mentioned the hepatitis C drug Harvoni costing $70,000 domestically versus $800 in Egypt. According to Reuters US drug prices are generally three times more expensive than England, six times higher than Brazil, and sixteen time greater than India. Why? Most countries negotiate pricing directly with drug companies resulting in better pricing. In 2006 the Medicare Modernization Act (MMA) was implemented after being signed into law three years prior. One of the unique provisos of the MMA prohibited Medicare from negotiating with drug companies for lower prices. Considering Medicare accounts for 30% of $360 billion total US drug spending in 2017, this seems either a gross oversight or is it something more? The 2000 election won by George W. Bush, 36% ($7.29 million) of pharmaceutical giving landed with Democrats vs. 69% ($18.63 million) for Republicans (8). By December 8, 2003 the Medicare Modernization Act was authorized but not yet implemented. Presidential election campaign contributions in 2004 saw 31% go to the Dems against 67% for the Republicans where GWB won his second presidential term. January 1, 2006 MMA was instituted and pharmaceutical companies enjoyed their payoff. At this time only the VA system negotiates pharmaceutical prices directly with companies and individual states may negotiate Medicaid prices only.

Lastly, the total global pharmaceutical market in 2016 was $1.05 trillion of which $450 billion or roughly 45% is attributed to the US. Let's view this another way: America holds 4.4% of the global population and pays for almost half the World's medications (9).

Drug sales and marketing:

Drug representatives are the visible whipping posts for allegedly helping drive pharmaceutical sales and prices higher. Maybe not. Examining Johnson and Johnson we find these fiscal year 2015 numbers:

Total Revenue: $71.89 billion

Advertising Spend: $30.12 million (0.04% of revenue)

Research and Development Spend: $6.967 billion (9.69% of revenue)

NOTE: According to the corporate 2016 annual report on page 36 the number for Sales, Marketing and Administration is $19.945 billion (27.74% of revenue) (10). Unfortunately the sales and marketing numbers are co-mingled with the administration costs. Understanding a truer cost would delineate the sales and marketing costs alone and specify what areas such as sales, sales, print media advertising, television advertising, and digital advertising the specific spending occurred.

ALSO NOTE: J&J has a consumer division, a medical devices division and a pharma division.

Sanofi is France's largest drug company and also a $40 billion global powerhouse. Their sales and marketing spending is reported at 3.1% of expenditures. When we compare pharmaceutical companies to the tech sector we find a range from 7% at Apple to 53% for Salesforce as seen in the below graphic from Sarah Brady at https://vtldesign.com/digital-marketing/content-marketing-strategy/percent-of-revenue-spent-on-marketing-sales/

The end result is variable, but this much is understood: the role of drug and device reps is a blip on the pharmaceutical cost radar, the reps bring new information to physicians who are grossly time starved. Lastly, no physician is paid by a pharmaceutical company to prescribe their drug(s). It is absolutely illegal. When looking for collusion and corruption the compass points upstream from physicians to the industrial- political complex. The saying, "Politics makes strange bedfellows," needs amending, "Politics takes on all bedfellows with cash."

BARRIERS TO SUCCESS

1. The FDA drug and device approval process is slow and expensive. Streamlining the process is essential to decreasing the time and cost

Take away: It is expensive and time consuming to discover and develop new drugs (about $2.5 billion and 8 or more years.

2. The US is arguably the most medicated country on the planet.

Take away: Becoming healthier remains essential for each of us to enjoy less medical expenses and greater quality of life.

3. PBMs are an unessential layer of the patient's drug procurement pathway.

Take away: We are seeing the purchase/merger of insurances and PBMs, which should theoretically decrease patient drug costs. Hopefully we will see what streamlining looks like when Jeff Bezos and friends roll out their take on improving healthcare.

4. US patients subsidize global drug prices.

Take away: We can no longer afford to support the world's drug prices as the United States Empire crumbles and the American citizens continue losing economic ground.

5. The connection between congress, POTUS, insurance companies, drug and device companies is rife with quid pro quo relationships.

Take away: Abolish lobbyists. Congress needs to amend Part D to allow Medicare drug price negotiating rights. This is where Warren Buffett can make his influence felt as part of the Bezos, Buffett, Dimon troika.

The nexus of Washington DC, insurance companies and pharmaceutical companies will be discussed in later segments of Healthcare Facts and Fiction: What the General Public Needs to Understand About Healthcare in America.

Up next is a rousing romp through a physician's life. What it takes to become a doctor, obtain and maintain the various licenses to practice, rules, regulations, reimbursements, and daily life. Not for the feint hearted reader.

(5) https://www.scientificamerican.com/article/cost-to-develop-new-pharmaceutical-drug-now-exceeds-2-5b/

(7) https://www.kff.org/infographic/10-essential-facts-about-medicare-and-prescription-drug-spending/

(8) Big Pharma Political Contributions - Drugsdb.com http://www.drugsdb.com/blog/big-pharma-political-contributions.html#ixzz57b6xuiGL